Contents:

FOMC minutes Written record of FOMC policy-setting meetings are released three weeks following a meeting. The minutes provide more insight into the FOMC’s deliberations and can generate significant market reactions. Foreign exchange/forex/FX The simultaneous buying of one currency and selling of another. The global market for such transactions is referred to as the forex or FX market. Forward points The pips added to or subtracted from the current exchange rate in order to calculate a forward price.

An asset’s closing price is the last level at which it was traded on any given day. Bears are traders who believe that a market, asset or financial instrument is going to head in a downward trajectory. In that regard, they hold an opposite view to bulls, who believe that a market is going to head upwards. Sudden price movements in the opposite direction, usually leading to false or bad signals. For example, while the price is rallying upwards suddenly it swings direction and follows a downward path until it bounces up again.

Market Facilitation Index

This usually happens during periods of high volatility, when traders use market orders and stop loss orders. A trading strategy that benefits from small price movements. A price level usually defined as a previous top, where selling pressure overcomes buying pressure. As a result, prices may find it difficult to break above. When a broker is not able to fill a trader’s order at the specific price due to an unusually rapid price movement.

Good ’til cancelled order An order to buy or sell at a specified price that remains open until filled or until the client cancels. Good ’til date An order type that will expire on the date you choose, should it not be filled beforehand. Gross domestic product Total value of a country’s output, income or expenditure produced within its physical borders. Gross national product Gross domestic product plus income earned from investment or work abroad. Guaranteed order An order type that protects a trader against the market gapping.

- A pending order used to contain risk, positioned to close trades if price starts moving unfavorably.

- Common stock and preferred stock are the two main classifications of stock.

- Risk Exposure to uncertain change, most often used with a negative connotation of adverse change.

- A colloquial term for reversing a transaction, e.g., a spot sale by means of a forward purchase or if done in error a spot purchase.

This refers to the amount invested in a security and exposed to market risk. Monthly report of current month’s employment numbers compared to the previous month. An increase of employed people is good for the currency where a decrease is negative.

Forex Trading Terminology: 15 Must Know Terms

Above the descending line implies a possible change in trend direction. Below the ascending line implies a possible change in trend direction. Gann considered the 45 degrees line as the most important in representing long-term trendlines. When enabled, all indicators and objects will be in the background whereas the price chart will be in the foreground. Difference between the close of the current price and that of the previous session. Financial services to the U.S. government, U.S. financial institutions and foreign official institutions.

Bill Williams’ https://forexaggregator.com/s, Oscillators, Trend and Volume indicators may serve as examples. The operation of crediting or debiting acertain amount of money from a client’s account when rolling the position over to the next value date (“to the next day”). The market where participants have the opportunity to buy, sell, exchange and speculate on currencies. The Forex market is comprised of commercial banks, central banks, investment management companies, hedge- funds, retail forex brokers and investors . Binary options are a relatively new financial instrument which differs in that they have a fixed cost and that risks and potential profit are known in advance.

Prices above the 45 degrees line indicate an uptrend, where below – a downtrend. During an uptrend, prices will find resistance at the lines above the 45 degrees line. Consequently, prices are expected to find support at the lines below the 45 degrees line. A technical Analysis tool used to draw a channel with diagonal Fibonacci retracements. In an uptrend, draw the channel line by connecting at least two tops.

An asset class is a category of financial instrument – these can be physical assets or financial assets. The area below the market price where buying interest overcomes selling pressure. A price level usually defined as a previous bottom, where buying pressure overcomes selling pressure.

AUD/USD Forex Signal: Rising Wedge – DailyForex.com

AUD/USD Forex Signal: Rising Wedge.

Posted: Tue, 03 Jan 2023 08:00:00 GMT [source]

Going long simply means to buy, while going https://trading-market.org/ means to sell. In equity markets, most traders are long in anticipation of rising prices. When Forex traders talk about profits or losses, they usually use the term “pips”. A pip is short from Percentage in Point and represents the smallest increment that an exchange rate can move up or down. Usually, one pip equals to the fourth decimal of most currency pairs.

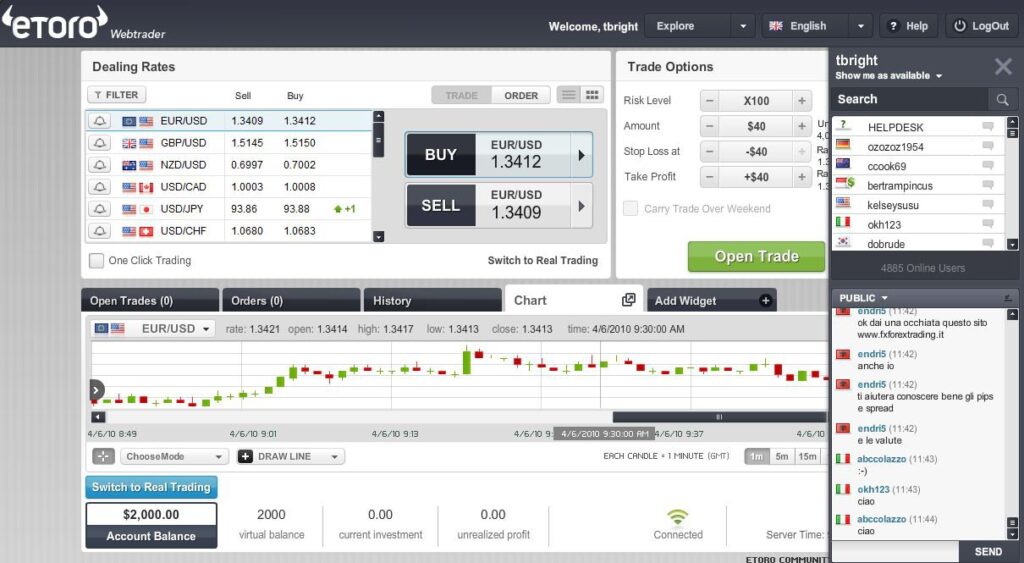

Automated trading system

A trader thinks that the European Central Bank will be easing its monetary policy in the coming months as the Eurozone’s economy slows. As a result, the trader bets that the euro will fall against the U.S. dollar and sells short €100,000 at an exchange rate of 1.15. Over the next several weeks the ECB signals that it may indeed ease its monetary policy. That causes the exchange rate for the euro to fall to 1.10 versus the dollar. Movement in theshort termis dominated by technical trading, which bases trading decisions on a currency’s direction and speed of movement.

Presented with the symbol C$, the currency is comprised of 100 cents. Central Bank A national bank mandated by the government to ensure low inflation, currency stability, and full employment. Some of its responsibilities include implementing monetary policy, serving as a lender of last resort, and monitoring the financial system. CFD A Contract for Difference – special trading instrument that allows financial speculation on stocks, commodities and other instruments without actually buying. Checks and Balances Act of implementing several measures aimed at curbing discrepancies or improper behavior within an entity. Chicago Board Options Exchange An exchange focusing on options contracts for indices, interest rates, and stocks.

A market where delivery takes place immediately after the trade of financial instruments. The delegates agreed to tie their currencies to gold and the US Dollar and maintain an exchange rate within a parity band of 1%. The rate at which a country’s central bank lends money to its domestic banks.

Likewise, the “Long entry” or “going long” are used for the buy positions. Sentiment Analysis – A study to predict a crowd psychology or herding behavior to determine the direction of the price movement of a security. The crowd psychology is often derived from an expectation of an outcome. This type of trading strategy is called Trading the Market Sentiment.

Account History

A graphical representation of the profits to a given options strategy for different underlying asset prices. An economic indicator which gauges the average changes on prices received by domestic producers for their output at all stages of processing. The maximum position, either net long or net short, in one future or in all futures of one currency or instrument combined which may be held or controlled by one person.

- In the course of a decline, a long white candle gaps above the previous black Marubozu and rallies higher, closing at the high of the session, demonstrating strong bullish power.

- The EMH assumes that the best strategy is to buy and hold.

- Forex charts can usually be extended to cover days, weeks, months, and even years.

- Reversal patterns that occur at the end of the trend, signalling the trend change.

- For a spot transaction, it is two business banking days forward in the country of the bank providing quotations which determine the spot value date.

The platform provides account management, live market prices, news feeds and charting tools. A continuation price pattern, when prices are trading in a confined area between two parallel flat lines. Even though it is expected to break out in the direction of the prevailing trend, it is not unusual to break out in the opposite direction. Breakout of the range should also be accompanied by heavy volume to be considered valid. Measuring implications are calculated as the width of the range. Camarilla Pivot Points provide a “road map” for both range and break-out traders, looking for potential turning points in the market.

What is Currency?

These lengths (i.e. expansions) are drawn starting from the end of wave 2 (i.e. third point). The theory holds that at these levels, (i.e. expansions) significant changes may be expected, for example, the end wave 3. A long white candlestick is formed at the end of a downtrend, preceded by a small black candlestick. After an established uptrend, the last top fails to exceed the previous top and prices fall below the last bottom. After an established downtrend, the last bottom fails to move lower than the previous bottom and prices rise above the last top. When the close price is above the mid-point of the daily range, then a positive number is returned implying buying pressure .

https://forexarena.net/ of appropriation of assets held in a foreign country. More potential sellers than buyers, which creates an environment where rapid price falls are likely. All options of the same class which share a common strike price and expiration date. Options on the same underlying futures being contract which expire in more than one month. Keeping open positions in the hope of a speculative gain.

Gold Technical Analysis: Price of Gold is Still Bullish – DailyForex.com

Gold Technical Analysis: Price of Gold is Still Bullish.

Posted: Tue, 15 Nov 2022 08:00:00 GMT [source]

A small candlestick body of either color follows a candlestick of a long black body. The bearish decline is running out of steam as shown by the presence of the small candle, which signals uncertainty as it is contained by the previous long body. The weakness of the market to move lower and the presence of the pattern at the end of a decline, signals possible bullish implications. The long white body that follows, extending above the second candle, confirms the bullish reversal. An Inverted Hammer formed at the end of a downtrend or at a support area has bullish reversal implications. Traders enter the market with long positions but eventually the sellers’ pressure overcomes buyers’ pressure and the candlestick closes at the lower area of the inverted hammer.